Highlights:

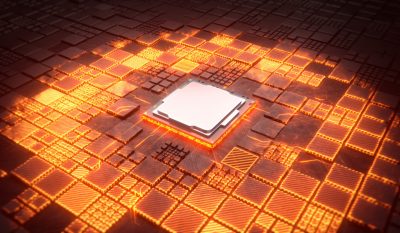

- With the construction of the two new facilities or fabs, Intel will possess a majority stake in the plants.

- Intel’s upcoming 20A semiconductor manufacturing process, often known as the Intel five-nanometer process, will be used to create the chips.

The Intel Corporation and Brookfield Asset Management, a well-known financial firm, have reached an agreement to pool their resources and invest up to USD 30 billion to build new CPU production facilities.

The details of the project were revealed by Intel.

The Toronto-based investment firm, Brookfield, manages about USD 725 billion in customer assets. The business will provide 49% of the necessary finance required to build two new processor manufacturing plants that Intel plans to build in Arizona. These actions are being planned as part of the partnership between the corporation and Intel. The remaining budget will come from Intel.

With the construction of the two new facilities or fabs, Intel will possess a majority stake in the plants. A deal has reportedly been reached between the chipmaker and Brookfield to split the profits generated from the fabs.

Although Intel first announced its intention to develop additional fabs in March 2017, actual construction did not commence until September. At the time of writing, four chip production facilities were already located on Intel’s 700-acre campus in Calendar, Arizona, where the new buildings will be constructed. The two new fabs are expected to reach full operation by 2024.

Intel’s upcoming 20A semiconductor manufacturing process, often known as the Intel five-nanometer process, will be used to create the chips. Intel’s computer chip manufacturing will radically change with the introduction of Intel 20A.

The chipmaker’s present processors are based on FinFET, an industry-standard transistor design. With the Intel 20A manufacturing process shifting online, the firm plans to switch from FinFT to RibbonFET, a new transistor architecture offering many noteworthy enhancements. PowerVia will also be included in the subsequent manufacturing process as with other breakthrough technologies. PowerVia is yet another technology created to standardize how a chip’s power is delivered to its many subsystems.

The company expects that integrating its RibbonFET transistor design and PowerVia will dramatically enhance processor speeds. Compared to current-generation silicon, Intel 4, a manufacturing process that will be released before Intel 20A, is expected to offer a 20% improvement in transistor performance per watt. The performance-to-power ratio of Intel 20A is expected to grow by another 15%.

As part of a larger strategy termed IDM 2.0, Intel unveiled plans for the two additional fabs in March. Scaling up the company’s chip production is a crucial objective of the plan. Since it first detailed IDM 2.0, Intel has announced plans to invest over USD 50 billion in semiconductor plants in Ohio, Germany, and Italy.

By the end of the year, Intel hopes to have finalized its USD 30 billion joint venture deal with Brookfield. The company claims that the transaction will allow it to gain access to capital below its cost of equity. Intel said the deal aims to “protect its cash and debt capacity” for future investments and make it easier to fund its dividend.

Intel chief financial officer David Zinsner said, “This landmark arrangement is an important step forward for Intel’s Smart Capital approach and builds on the momentum from the recent passage of the CHIPS Act in the U.S.” He added, “Semiconductor manufacturing is among the most capital-intensive industries in the world, and Intel’s bold IDM 2.0 strategy demands a unique funding approach.”

Intel has taken several measures to improve the infrastructure funding approach – the current investment deal with Brookfield is one of them.

Today, the firm disclosed that it is “aggressively building” shell space, an industry term used to define empty chip fabs that have yet to receive manufacturing equipment. It takes less time to convert such fabs into operational chip facilities than to construct an entirely new facility.

Last year, Intel launched a new business unit with the sole aim of using Intel’s manufacturing facilities to create chips for other companies. Intel recently announced that many companies planning to produce processors at its facilities “have indicated willingness to make advance payments to secure capacity.” In an earlier report, the firm stated that 30 clients were developing test chips as of the second quarter.

Zinsner also stated, “Intel’s Smart Capital actions provide Intel with greater flexibility, reduce overall gross capital needs and act as a tailwind to adjusted free cash flow and gross margin.”