Highlights:

- Business transactions can come with expenses that reduce the value of subsequent dealings. Real-time payments have the potential to minimize or eliminate these costs, helping businesses retain more of their revenue.

- RTPs eliminate waiting for payments, so businesses get their money faster.

The landscape of payment processing is evolving rapidly. Conventional approaches are insufficient to maintain competitiveness in today’s business environment. To thrive, merchants and other businesses need to embrace new standards and technologies.

Payment processing itself is a complex web of systems and stages. However, when explained clearly, it becomes a powerful tool for businesses. One such innovation is real-time payments. The benefits of real-time payments are enormous, helping businesses to achieve high-grade financial performance. Let’s start with the basic definition.

What are Real-time Payments?

Real-time payments represent immediate transactions processed instantly and uninterruptedly, every hour of every day. In contrast to conventional payment infrastructures, which may entail prolonged processing times spanning from hours to days, real-time payment (RTP) systems rapidly transfer funds from one bank account to another.

This transfer can take place within mere moments of the transaction’s initiation, ensuring that funds are promptly accessible to the designated recipient. However, certain factors play a crucial role in driving the adoption of real-time payments and must be taken into consideration.

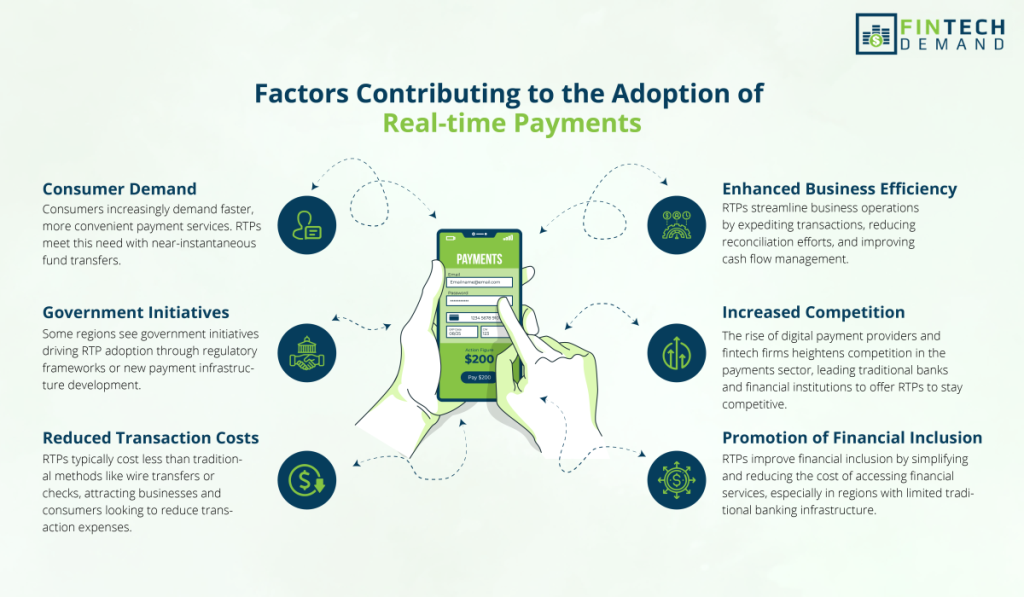

Factors Contributing to the Adoption of Real-time Payments

RTP adoption drivers vary by region, but they’re poised to grow as demand rises for faster, more convenient, and cost-effective payment services from consumers, businesses, and governments.

What are the Benefits of Real-time Payments for Your Business?

Businesses today need innovation to stay competitive. Real-time payments, with their instant transfers, are a game-changer.

Let’s explore some benefits:

-

Heightened efficiency and productivity

The instantaneous nature of RTPs obviates the necessity for manual intervention in payment procedures, thereby augmenting overall operational efficiency.

Consider a utility company: with an RTP transaction, the business no longer needs to await the clearance of cheques or endure the batch processing delays of electronic payments. Instead, payments can be received instantaneously, mitigating the administrative burden.

-

Enhanced cash-flow management

Real-time payments empower businesses to swiftly receive funds immediately post-transaction. This expedited transfer greatly enhances cash-flow management, enabling businesses to utilize funds promptly upon receipt, rather than enduring days of waiting for transaction clearance.

For instance, a supplier can promptly reinvest payments received from a retailer into raw materials without the customary delay associated with bank processing times.

-

Improved cash management

In addition to optimizing cash flow, real-time payments contribute to enhancing your business’s cash management. Prospective investors, collaborators, and acquiring entities often regard cash management as a robust indicator of financial stability.

Effective cash management demonstrates your company’s capacity for capital flexibility to seize investment opportunities or mitigate potential losses.

A financially robust entity possesses the liquidity to fulfill all impending obligations and liabilities. By adopting a swifter payment system, your business instills confidence in its financial robustness and ability to navigate challenges with resilience.

-

Continuous availability

Traditional banking systems adhere to “banking hours” and often suspend transaction processing during weekends or holidays. In contrast, RTPs operate round-the-clock, facilitating businesses to execute payments at any hour.

This feature is particularly advantageous for e-commerce enterprises catering to customers across various time zones and operating seamlessly throughout the day.

-

Simplified processes

Payment methods vary significantly in their efficiency. B2B payments are often perceived as cumbersome, time-consuming, and expensive to manage. However, an RTP network simplifies the payment process, reducing costs and eliminating unnecessary steps while upholding anti-fraud measures and transparency standards.

Consequently, businesses can bid farewell to exorbitant fees and redundant paperwork associated with real-time payments. With payments swiftly reconciled, you can redirect your focus towards more critical aspects of your business operations. This is one of the significant benefits of real-time payment.

-

Enhanced customer experience

Customers leveraging RTPs relish the convenience of making instantaneous payments at their convenience. This capability significantly amplifies the customer experience, especially within sectors such as e-commerce and software-as-a-service (SaaS).

For example, a customer purchasing a digital product can promptly pay and access the product instantly, fostering a frictionless and efficient purchasing journey.

-

Transaction assurance

RTP transactions deliver immediate payment validation, providing businesses with certainty that transactions have been effectively finalized.

This assurance holds particular significance in industries like real estate, where swiftly transferring and confirming substantial sums can expedite the entire process.

-

Facilitation of new business opportunities

RTPs pave the way for novel business models and opportunities. Take, for instance, the gig economy, where freelancers and contractors often grapple with extended payment wait times. RTPs enable instantaneous payment upon project completion, alleviating significant burdens for gig workers and potentially attracting more talent to the industry.

-

Remove superfluous expenses

Business dealings often entail associated expenses that diminish the value of subsequent transactions. Real-time payments offer the potential to diminish or eradicate these unnecessary drains on cash flow, enabling businesses to preserve a greater portion of their revenue.

-

Data-rich transactional insights

RTP systems accommodate the transmission of extensive data compared to traditional payment methods, furnishing businesses with invaluable insights.

For example, an RTP transaction can encompass invoice particulars, purchase order numbers, or other pertinent information, simplifying payment reconciliation and account management for businesses.

Wrap Up

Real-time payments offer numerous benefits to businesses, including enhanced cash flow, reduced fraud risks, and transformed customer experiences. With these systems, businesses can swiftly access funds, manage liquidity efficiently, and streamline receivables processing.

The robust security measures of RTPs help prevent fraud and minimize financial losses. Additionally, their user-friendly interface, flexibility, and seamless integration contribute to a positive customer experience, fostering trust and loyalty.

The above benefits of real-time payments help businesses uncover new opportunities, enhance financial performance, and drive growth in the rapidly evolving payment market.

Enhance your understanding by delving into various finance-related whitepapers accessible through our resource center.